Launching gigaETH: First GigaAsset on Enjoyoors

We’re excited to announce a major milestone at Enjoyoors: gigaETH minting is now live.

GigaETH is the first of our gigaAssets—a new class of soft-pegged synthetic assets that unlock idle capital and power yield strategies across DeFi.

You can now stake your gigaETH directly on Monad testnet and soon begin using it in integrated liquidity pools like Ambient.

Here’s everything you need to know.

What is gigaETH?

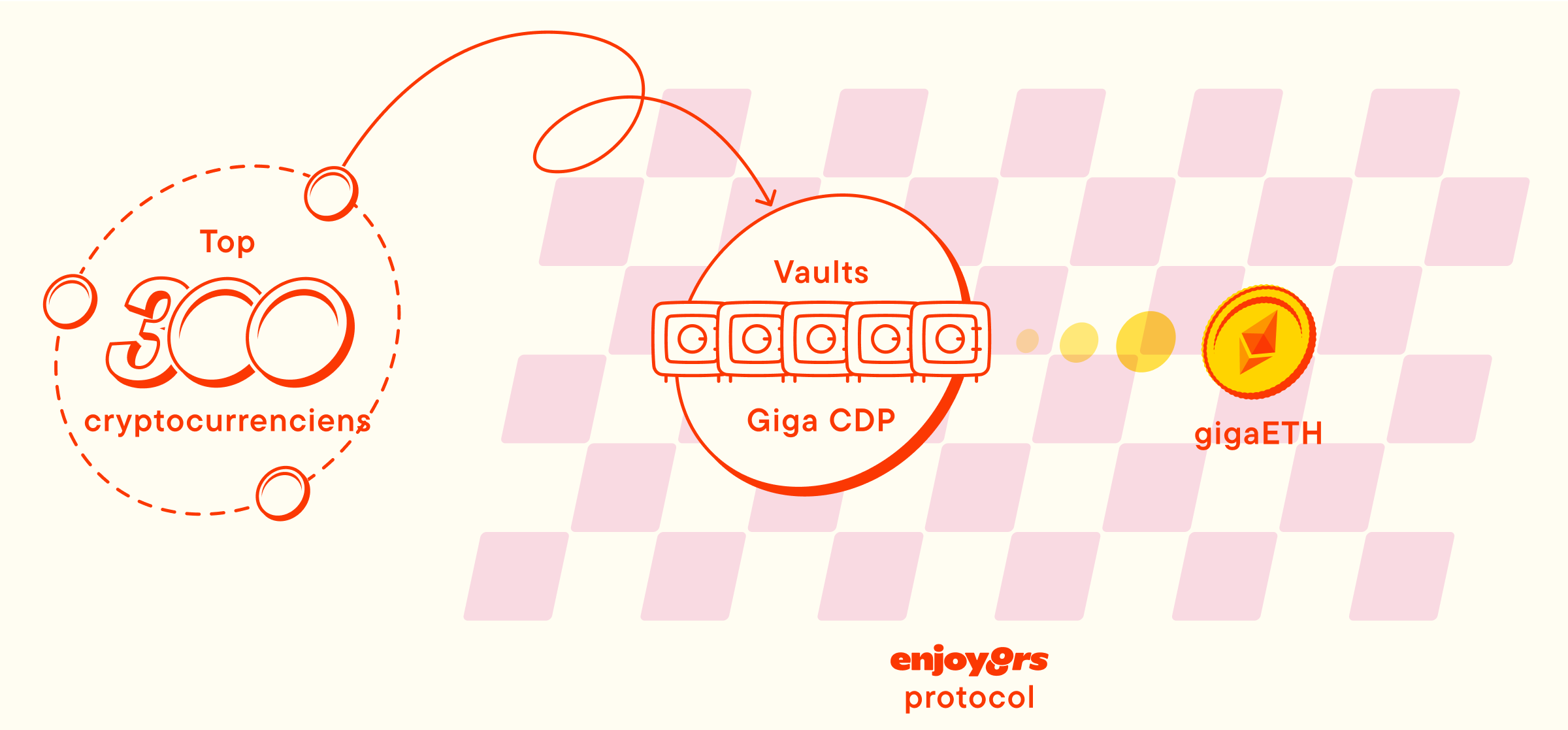

GigaETH is a synthetic representation of ETH minted by the Enjoyoors protocol. It’s not just a wrapped version of ETH—it’s backed by all user-deposited assets in Enjoyoors' vaults on all blockchain networks. This diversified basket includes primary assets (protocol native tokens, governance tokens, memecoins, etc) as well as a variety of their derivatives (LSTs, DeFi LP tokens, and more).

When you deposit an asset into an Enjoyoors vault, its value is rehypothecated into a gigaAsset like gigaETH, which represents synthetic liquidity that can be deployed into any protocol.

This foundational process of rehypothecation is illustrated in the diagram below:

Why it matters

GigaETH acts as a yield proxy for all assets in the Enjoyoors vaults - unifying their value and solving two major pain points in crypto today:

- Idle assets – Vast portions of DeFi capital (over $1.5T) sit unproductive, but gigaETH converts that into usable, yield-bearing liquidity.

- Composability – Most yield strategies are chain or protocol-specific. GigaETH creates a unified asset standard that can move, farm, lend, or stake across all of DeFi’s most active protocols.

This turns Enjoyoors from a passive vault system into an active liquidity engine.

How it works

Here’s how we mint gigaETH:

- Users deposit assets into an Enjoyoors vault

- The Enjoyoors protocol evaluates their value and mints corresponding gigaETH at a certain LTV defined by the risk framework

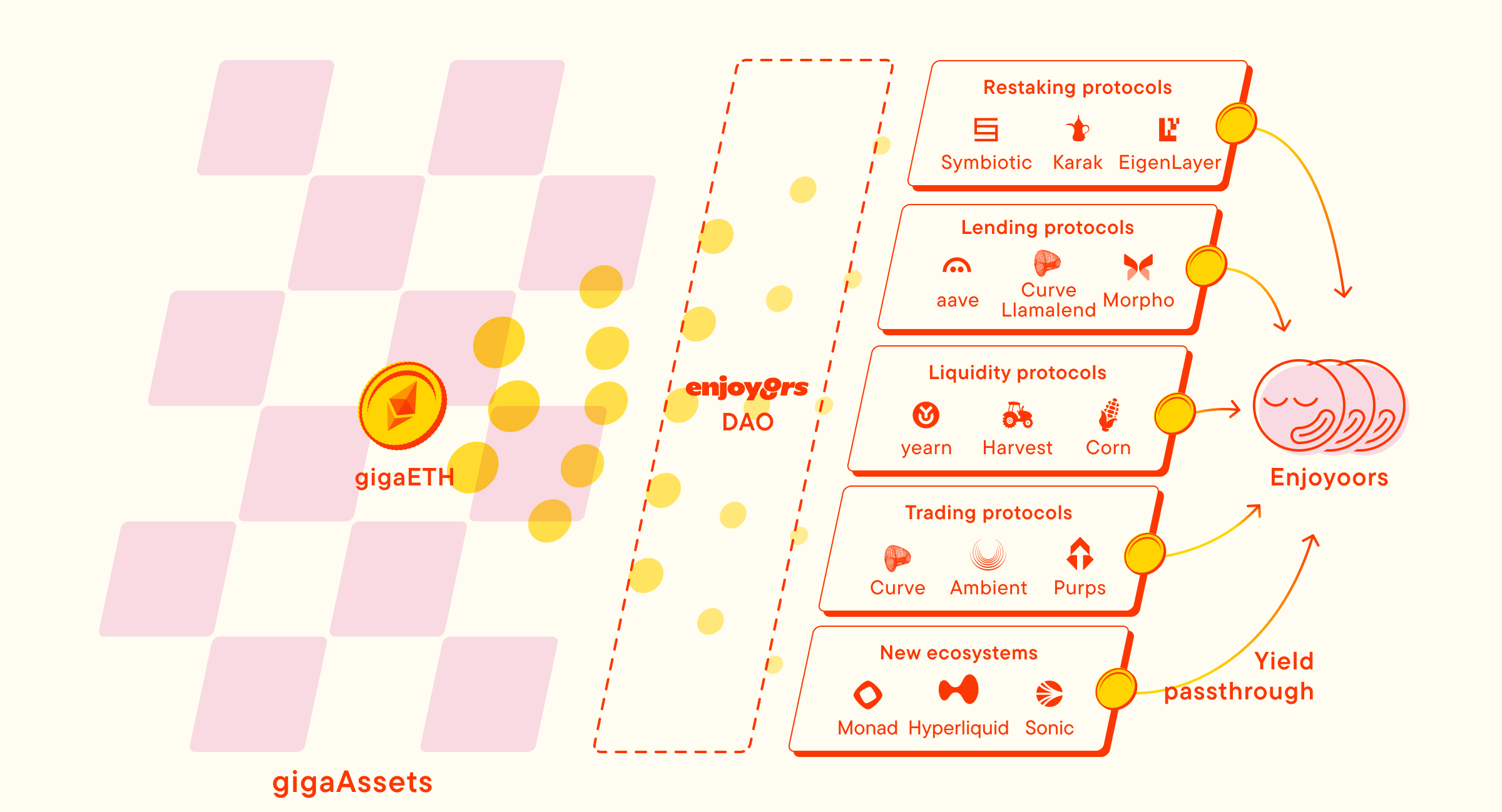

- The Enjoyoors protocol deploys gigaETH to multiple DeFi verticals (lending, restaking, trading, liquidity farming, etc)

All yield accrued on gigaETH is funneled to the initial depositors

Key features of gigaETH

We ensure that each gigaETH is backed by the users’ full portfolio of assets with overcollateralization at any time. The entire process is managed by gigaCDP—our decentralized collateral engine that includes a risk management framework and a toolset to maintain soft pegs and safety.

Additionally, the overall circulating supply of gigaETH is controlled by the Enjoyoors protocol instead of minting gigaETH for end users. This is an important feature of the protocol that significantly differentiates it from CDP-based peers and enables ultimate efficiency in liquidity management.

GigaETH also obtains a lot of utility. If acquired from the open market, a gigaETH holder can use it as a proxy to multiple yield-bearing ETH wrappers or deploy gigaETH holdings into one of the available strategies—lending, restaking, LPing, etc, to earn yield.

What’s next?

This is just the start. With gigaETH now mintable, we’re unlocking a range of integrations that stretch across ecosystems.

More use-case scenarios, strategies, and vault mechanics will be announced soon.

Learn more about gigaAssets